Insights at the trade level serve as crucial pieces of information, providing a comprehensive overview of both the performance and risk associated with your trades. These insights typically result from a meticulous analysis of each of your past trades. For traders, gaining access to trade-level insights is invaluable, as it enables informed decision-making and facilitates improvements in overall trading performance.

3 types of trade level insights you get with the Samco trading app:

-

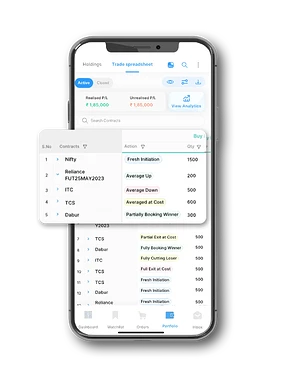

Trade round view

Most trading strategies have two legs. The first leg involves a buy or sell trade, whereas the second leg involves a square-off trade. The trade book of most stock trading applications only groups your trades chronologically. This makes it harder to get a comprehensive picture of your trading strategy. -

Trade level insights

Trade level insights give you a quick overview of the nature of each trade you make. With the ‘My Trade Story’ feature in the app, you can dissect each trade into the following 4 different actions:

Fresh initiations

Average up, average down, or average at a cost

Partially booking winners or losers

Fully unwinding winners or losers -

Performance level insights

As a trader, you also need to be aware of the performance of each trade you enter into. The new-gen Samco trading app classifies your trades into two categories based on how they have performed relative to your benchmark index:

Outperforming trades

Underperforming trades

This sums up how the trade-level insights offered by the next-generation Samco trading app assist in evaluating the efficacy of your trading strategies.

If you found this interesting and want to read more, check out our detailed blog.