Recent Breakout in 2023

Breakout in June 2020

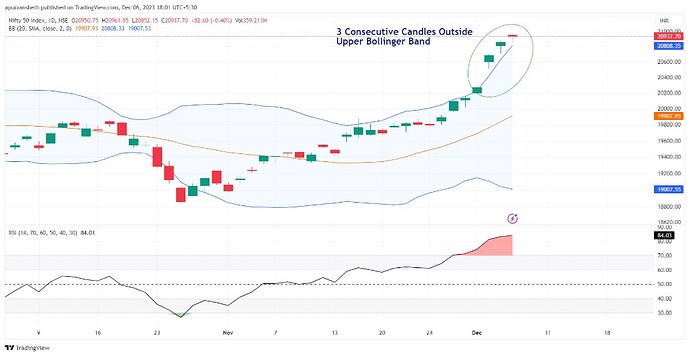

Nifty has given a massive breakout followed by a strong up move after the state assembly elections were announced last Sunday. The index is up by 4.25% in just 5 trading sessions.

The up move has been so strong that the last three days entire candle has formed above the upper Bollinger band.

Bollinger bands are normally plotted 2 standard deviations away from 20 days moving average. When price touches either side of the bands there is a chance that it could reverse direction and move towards the mean.

Formation of three consecutive candles outside upper bands is an extremely rare event. This has happened only once in last 23 years. It happened last time on 3 June 2020 when markets was bouncing back from Covid lows. Markets had moved up by 8.02% five days prior to this occurrence. But it generated a flat return of 0.54% five days after this occurrence.

We believe this time around too markets are likely to consolidate and not move further up in a hurry. Apart from Bollinger Bands the daily RSI is also placed in overbought territory. Nifty can even pullback and give up some of the gains over the next 5 sessions.

The best way to play this strategy will be to buy 1 Nifty 20900 CE 14 December Expiry & sell 2 Nifty 21000 CE 14 December Expiry. The strategy will generate maximum profit of Rs 9,078 if Nifty expires at 21000 levels next week. It will start generating losses if the index trades above 21,181. The margin needed to execute this strategy will be about Rs 1.26 lakh.

| Date | Open | High | Low | Close | Standard Deviation (20) | SMA (20 Days) | 20-day SMA + (STDEVx2) | 20-day SMA - (STDEVx2) | Low above Up BB | Consecutive lows above up BB | 5 Day Fwd Return % | 5 Day Bwd Return % |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 03-Jun-2020 | 10108.3 | 10176.2 | 10035.55 | 10061.55 | 328.4 | 9300.80 | 9957.59 | 8644.00 | 1 | 3 | 0.54% | 8.02% |

| 06-Dec-2023 | 20937.7 | 20961.95 | 20852.15 | 20950.75 | 451.7 | 19908.58 | 20811.99 | 19005.18 | 1 | 3 | ?? | 4.25% |