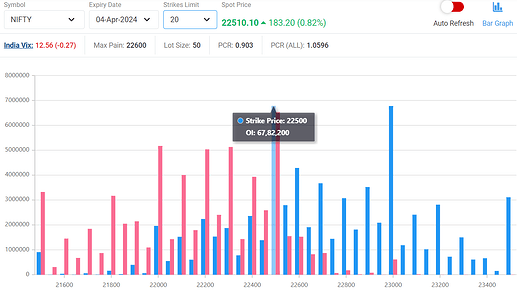

With the country going to polls from April 19 and the fourth-quarter earnings season coinciding, the Nifty is expected to see heavy volatility in trade in the April series. Both the call & put writers have been fiercely battling out at 22,500 Strike. The winner of this battle will set the tone for future direction in Nifty

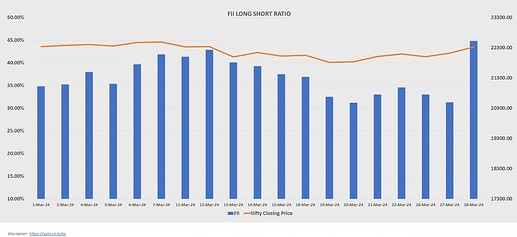

The FPI activity in the index futures largely remained subdued throughout the March series. The activity seemed to pick up pace in the first half of the series with the long-short ratio moving from 34.84 percent on March 1 until 42.89 percent on March 12, but fizzled out quickly to end up at 31.34 percent on the penultimate day of the March expiry series. The FPIs made a strong comeback on the last day of the March series. They built long positions and liquidated short positions in Index futures, leading to a jump in the Long Short ratio.

The Put-Call Ratio (PCR), a sentiment indicator, started with 1.33 on the first day of March series and closed at 1.01 on the last day of the series. Call writers (bears) overpowered Put writers (bulls) throughout the March series. However, with the momentum picking up in the Nifty, the Put writers (bulls) can very well make a comeback

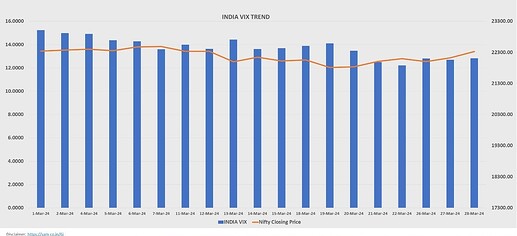

Volatility has cooled off since the start of March series expiry. The India VIX, known as the fear indicator, took multiple resistance, about four times around the 16.5 levels in the first two months of 2024. Volatility fell nearly 17 percent in the March series, which gave comfort to the bulls. The VIX closed at 12.83 on the last day of March series

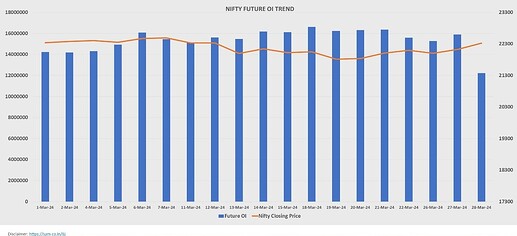

The Nifty will start the April series with an open interest (OI) of 1.22 crore shares compared to an OI of 1.40 crore shares at the beginning of the March series. The benchmark rose 1.57% in the March series with a higher cost of carry (CoC) (+0.62 percent) and a fall in open interest, indicating covering of short positions in the March series

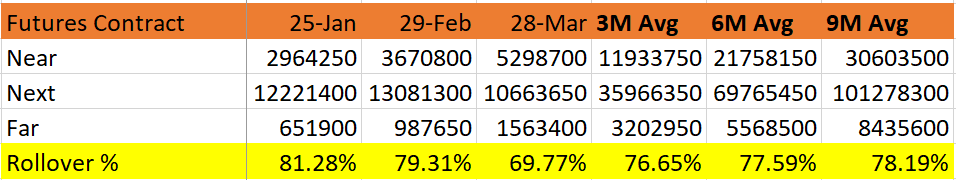

Rollover is a process of carry forwarding an existing position from one month to another month. The Nifty futures rollover stood at 69.77 percent, which is lower compared to the last month’s expiry rollover of 79.31 percent and its three-month average of 76.65 percent. While a high rollover indicates a strong sentiment, lower- than-average rollovers call for cautiousness

The Nifty has given a higher close (above previous week’s high of 22,181) on the weekly chart. It seemed Nifty might come under selling pressure having closed below the 50-day exponential moving average (DEMA) consecutively on March 19 and 20, but the index held on to this level and moved up sharply. If Call writers (bears) exit from the 22,500 strike, we may see Nifty scaling a new high in the April series

Disclaimer - https://sam-co.in/6j

Stay updated, visit ![]() https://sam-co.in/7d

https://sam-co.in/7d