If you’ve experience in stock market trading, you may recognize indices such as the Nifty 50 or the S&P BSE Sensex. These indices serve as statistical benchmarks, comprising a designated group of stocks or securities.

The Indian stock market has various types of indices belonging to different categories such as:

• Broad market indices, comprising leading stocks

• Sectoral indices, encompassing stocks from different market sectors

• Market capitalization-based indices

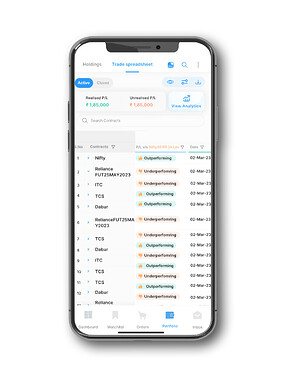

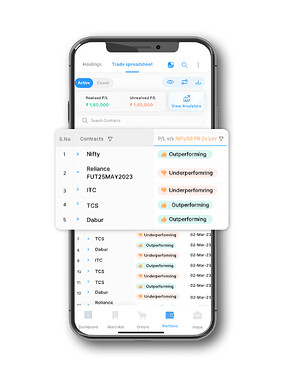

Improve your trades with benchmark-level insights from the Samco trading app.

Here are 2 key benchmark-level insights you get in the app

-

Comparison of trade performance

Selecting a benchmark index is crucial to assess the performance of your portfolio against a standardized measure. The performance insights provided in the application simplify the evaluation of your trades, allowing you to compare them with a benchmark index of your choosing. -

Quantifying potential profits and losses

Beyond just evaluating your trades against the benchmark index, the new Samco trading app also provides insights into another #AndekhaSach—revealing the profits or losses that may have been incurred if you invested in your selected benchmark index.

By leveraging the insights at the benchmark level, you can acquire a comprehensive understanding of how your trades stack up against your selected benchmark index. This empowers you to make profitable trading decisions that capitalize on prevailing trends in the broader market or specific sectors.

For a detailed exploration of this feature, check out our blog